Metavers Tribune – Pierre Berendes: « N’ayez pas peur du métavers, j’ai vu la preuve que ça peut marcher »

Let’s assume in our case is a startup who has made a last round of up to 20m€

Let’s see and compare some figures regarding London vs Paris, Uk and France in Europe

Since 2016 ( cohort of new scale up 2016-2018) :

478 scale-up in Europe

59 scale-up in France ; 40 à Paris : 68% of French scale-ups are located in Paris

166 scale-up in the UK ; 107 in London : 64%

87 scale-up in Germany ; 49 in Berlin : 56%

Londres + Paris represent 31% of european scale-ups

If you add Berlin : 41%

Several observations to start with

• Berlin+Paris+London still big 40% of all european scale-ups

• London & Paris similar in terms of « tech » cities : huge « winner takes all » situation where they drive 65%+ of all their national sale-ups ; different in Germany and Southern countries where some second hubs tend to emerge (Germany with Munich, Spain with Barcelona, Portugal with Porto, Italy with Milan)

• Time to raise & amount raised seems to quite similar in Europe at this stage.

• Median amount raised : €34m (€33m in Paris, €34m in London)

• Median time to raise since previous round : 15 months (17,5 in Paris, 16 in London)

« Let’s start with stating the obvious: to have good scale-ups, you need good business. But we will assume that talent is equally distributed across all countries, and that there are therefore as many potential successful entrepreneurs and unicorns in France as in the United Kingdom, for example.

The question we are going to ask ourselves is how to build an ecosystem that, at worst, does not slow down the growth of these scale-ups, and at best supports them and encourages them at all stages of their development. What we can learn from other ecosystems.

The first step is inception: you need to have an efficient financing network so that start-ups can easily access the first series and so then have as many potential candidates as possible for C+ rounds. From this point of view, France is quite well off. Indeed, if we compare, for example, with the United Kingdom, we have almost the same number of fundraising events per year in France. The total amount raised is higher in the United Kingdom, because there are precisely large transactions that raise the total, but in France there are as many small transactions, i.e. Seeds (~350 deals 2017) Series A (~250 deals 2017), as in the United Kingdom. This is a very positive sign because if we do not yet have so many scale-ups or unicorns, we have so many companies that aspire to this status and that are accessing financing. The renewal of the talents is therefore very largely assured and we can be confident that many French champions will emerge from these small series in the coming years.

One of the main explanation for this dynamism of small to mid cap financing in France is the BPI. It is the most active investor in France in terms of round participation, and a valuable partner in sealing many deals. The activism of an actor with such a financial strike force is an encouraging point regarding the future of French scale-ups. Indeed, for example in the United Kingdom, there is no equivalent actor. This absence is compensated by other actors, in particular by business angels and crowd-equity networks, which are much more structured and active than in France. They are the ones who provide the complement to this small to mid cap financing, which is partly provided by the BPI in France.

Crowd equity is stalling in europe but still do a got part of the job In UK

But regarding scale-ups, the main difference is that the BPI has the financial strength to take on additional series, and put back into the pot in C+ series to continue to support fast-growing startups. On the contrary, if we take Crowdcube in the United Kingdom, for example, which is the most active non-VC investor with nearly 100 deals per year, it represents only 80 millions in cumulative total amount raised on these 100 deals. This means that the associated investors in Crowdcube do not have the capacity to take on the financial follow-up required by a scale-up. This is the hallmark of business angels, who are essential actors in the start-up process but whose financial impact decreases as the series increases, unlike an actor like the BPI.

In the United Kingdom, regulatory and tax conditions are largely favorable to venture capital and investment, particularly in promising technologies, not only for start-ups (SEIS scheme), but above all for scale-ups (EIS scheme). Proof of this is the number of business angels recorded in the UK: 2,069 (Source Angel List 2015) compared to 404 in France (five times more). Employment in the digital sector is abundant and represents 5.5% of the total working population according to the 2016 TechNation report, while France reaches 3.7% according to the AFII, which has been growing strongly in double digits in recent years; without being able to establish a direct causal link between these programs and the vitality of employment observed in recent years in the United Kingdom. It should nevertheless be noted that in a context of high instability linked to Brexit, growth weakens to 2%, at the same level as France, but full employment remains (4.5% unemployment rate).

So, in short, in France, we have enough talent with access to enough funding. The question now is how do we get through this step, how do we manage to raise the few tens of millions needed to take a startup to the next level? You have probably read it in the press: for the first time in 2017, French VCs raised more than British VCs and took first place in Europe in terms of amounts raised. It can therefore be said that the ecosystem’s financing needs are largely met, even for large series.

Nevertheless, it would be a little ambitious to be so sure. In the United Kingdom, where we are used to making series at over 100 million, the figures show that the ecosystem relies heavily on foreign funds to provide this depth in round tables. In the United Kingdom, foreign funds are present in 1/3 of deals, whereas they are only present in 15% of French deals. It is probably partly a question of culture and history, of a link with the United States, and English Speaking is an undeniable asset. Nevertheless, we will have to be able to attract more foreign funds to our operations so that France can pull up its series and be sure to ensure the financing of its scale-ups

Among some of the Huge Deals of last year : Deliveroo, Farfetch, Transferwise.

• Portugal > Farfetch : Estonia > Transferwise (?)

The last point for a scales-ups ecosystem, which is less intuitive, is the issue of exits. Because to put several tens of millions in a scale-up, you need to have prospects of return on investment, and, above all, cash to put in the pot.

From this point of view, Tech M&A is doing well in Europe. But Avolta Partners recently published a study on the subject that highlights an interesting point: 60% of acquisitions in Tech are made by companies created less than 20 years ago. This means that it is these young companies, these digital natives, who have best integrated the logic of venture capital and the strategic leverage that Tech M&A represents for a business. For example, Snapchat buys Zenly, or Zendesk buys BIME.

On the other side of the spectrum, it is striking to note that companies created before 1970, i.e. a significant share of the CAC-40, represent only 10% of Tech M&A. For the time being, they have not deployed their financial expertise to Tech acquisitions at all; they have not yet integrated the strategic advantages of being proactive in the acquisition of new technologies or new digital channels.

So in the end, it is a bit of a call to big corporations to take responsibility for financing innovation, as some are already doing very well. This will be beneficial for them, for their business, and for the ecosystem. This would make it possible to bring out many more tricolour scale-ups, if their M&A opportunities increase in the medium and long term.

Le 30 octobre 2018, dans Cercle les Échos, l’économiste Nouriel Roubini a publié un article concernant la blockchain et les cryptomonnaies.

Un extrait : « La technologie à l’origine du bitcoin est présentée comme un possible remède à tous les maux, de la pauvreté à la famine en passant par le cancer. Mais, derrière un discours de décentralisation et de liberté numérique, la blockchain cache une course aux profits pour une minorité. La valeur du bitcoin ayant chuté d’environ 70 % depuis son pic de la fin de l’an dernier, la mère de toutes les bulles a désormais éclaté »

Roubini, économiste pessimiste et fantasque, a gagné sa réputation pour avoir prédit la crise immobilière aux US. Pour être précis, l’économiste chroniqueur prédit perpétuellement des crises sur tous les marchés. Et de temps en temps, les faits lui donnent raison (d’où ses surnoms de Permabear ou Dr Doom )

Les propos de l’oiseau de mauvais augure sont articulés autour de deux thèmes : les ICOS et TGE sont des « arnaques » et la blockchain ne sert à rien.

En regardant de façon détaillée, les chiffres cités sont un peu orientés pour faire valoir ses opinions :

· Le bitcoin a baissé depuis son plus haut. C’est vrai et par définition, en effet on aurait pu dire qu’il a monté depuis son plus bas. Roubini veut mettre en avant la volatilité dans l’année. Cependant, depuis le 5 septembre 2018, la stabilité des prix de Bitcoin a été telle que Wall Street fut plus volatile que les actifs numériques. De bons vieux marchés financiers sont sensibles à : la hausse des taux d’intérêt, aux manipulations de la Fed, aux guerres commerciales, aux tarifs douaniers et même à l’incertitude sur l’Italie et Brexit.

· 75% des ICOS sont des « arnaques » (scams en anglais). Les chiffres sont issus d’une étude du cabinet SATIS (promu par bloomberg) qui compte les ICOs qui veulent se lancer, pas celles qui reçoivent de l’argent. C’est comme dire: 75% des « projets » de startups encore non créées sont des « arnaques ». https://research.bloomberg.com/pub/res/d28giW28tf6G7T_Wr77aU0gDgFQ

(Étude à lire pour bien voir le panorama complet de ce qu’il s’est passé autour des TGE depuis quelques mois.

· Les Blockchains deviennent privées. Pour Roubini, les blockchains deviennent de plus en plus privées, contrôlées par de petits nombres d’acteurs, et pour ceci, ne constituent plus une vraie innovation économique. Mais Roubini ne prend pour référence que l’utilisation de la blockchain en interne dans le cadre de grandes entreprises. Quel dommage! C’est un biais évident. Certes, certains projets déclinent un peu de « centralité » pour pouvoir mieux se marier avec l’héritage entrepreneurial, mais je pense que Roubini ne prend pas conscience de la révolution qui est en cours avec des entreprises qui acceptent de travailler entre elles dans un même secteur en partageant des données, des processus et de la valeur. Il sera surpris de voir ces groupes d’entreprises qui créent une valeur écosystémique plutôt qu’organique….même si nous savons tous que c’est un pari difficile.

Great discussion with Jean-Luc Chetrit president of UDA ( Union des Annonceurs ) and Benjamin Grange ( President of Dentsu-Aegis Consulting) concerning the new paradigm in advertising.

Great sharing with Benjamin Eymere ( Jalou Group ) who is currently in the process of tokenize his business for the magazine L’Officiel.

I am really bullish when I see the number of new serious and bold projects in this space :

Thanks to IAB for this job of listing, I have added some…

Un interview de 18′ ( très long pour ce format 🙂 ) pour passer en revue l’état des lieux des ICOs en France suite à la parution d’un baromètre des ICOs en France.

Nous avons eu la chance de pouvoir également remettre ce baromètre en avance de phase au gouvernement dans le cadre du rapport Landeau remis à Bruno Lemaire la semaine dernière. Il est largement utilisé et figure même en annexe du rapport.

Voici la vidéo :

Voici quelques extraits de l’article paru sur Frenchweb :

La semaine dernière, Jean-Pierre Landau, sous-gouverneur honoraire de la Banque de France, remettait son rapport sur les cryptomonnaies à Bruno Le Maire, ministre de l’Économie et des Finances. Très attendu, le document met en lumière une position finalement plus souple que prévue sur les monnaies virtuelles.

Parmi les questions abordées dans cet ouvrage d’une centaine de pages, figure en bonne place celle des ICO. De plus en plus utilisées, les ICO (Initial Coin Offerings), c’est-à-dire des levées de fonds en cryptomonnaies, sont devenues des moyens faciles pour les entreprises du monde entier afin de lever des millions de dollars en l’espace de quelques minutes, à l’image de Telegram. Si ce mécanisme de financement est déjà très populaire en Asie et aux États-Unis, il commence à prendre de l’ampleur en France. Un essor auquel s’est intéressé la banque d’affaires Avolta Partners pour éclairer la mission dirigée par Jean-Pierre Landau.

Dans son Baromètre des ICO en France, Avolta Partners s’est ainsi attelé à dresser un état des lieux des levées de fonds en cryptomonnaies effectuées dans l’Hexagone. Entre 2014 et 2018, et essentiellement au cours de ces 18 derniers mois, la banque d’affaires a identifié 16 ICO domiciliées en France et possédant une équipe française, qui ont permis de récolter environ 130 millions de dollars, pour un peu moins de 340 millions de dollars de valeur réellement émise sur le marché.

I love my Avolta Team.

Spending time with them during this offsite in Ibiza was not a revelation, but more a confirmation.

They fit with each of my core values in life. They even live up to those values every day. They are smart, commited to success, and adventurous.

This is the thing I the most proud of in this company, is the way people are helping each other to be better and to success.

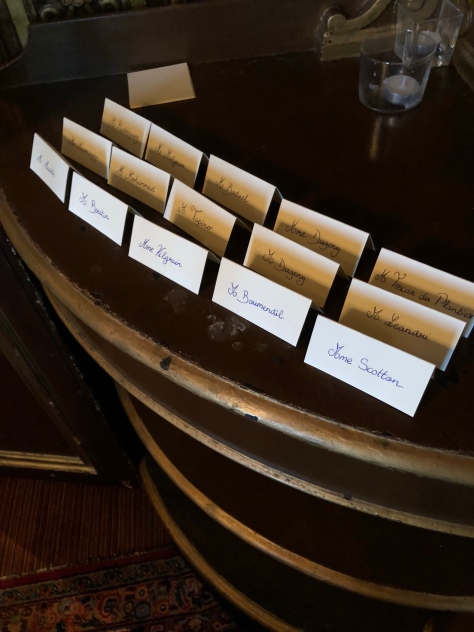

J’étais l’invité, hier soir, d’un ‘dîner confidentiel’, série de dîners conférences organisée par deux de mes amis dans le très célèbre restaurant de La Pérouse.

Ce fut pour moi l’opportunité de pouvoir parler de la Révolution Blockchain avec une audience de chefs d’entreprise, de personnalités des médias et des arts.

Un échange nourri de bonnes questions. En espérant que chacun soit parti avec une vision plus claire de ces enjeux sociétaux qui sont devant nous et entre nos mains.

Glenapp 30 octobre 2022

Hugues Rey's News & Curated Content - Meaningful Marcom X Useful Tech

The latest news on WordPress.com and the WordPress community.